A Problem with RGGI, for People Like You and I

Soon after taking office, Virginia Governor Glenn Youngkin signaled he will revoke Virginia’s participation in the Regional Greenhouse Gas Initiative (RGGI) to reduce energy costs to Virginians. As reported by Virginia local 13 News Now, the Governor claimed RGGI was too expensive for Virginians and implied it would contribute to the disproportionately high rates Virginians are leaving state to avoid the high cost of living (Steger, 2022).

Here’s the problem: it is extremely difficult for people like you and I to get a clear-eyed view of RGGI’s performance. It’s not unreasonable to think a singular, unbiased source could develop a well-thought program to accurately measure carbon emissions and electricity rate changes resulting only from RGGI’s performance. It is also not unreasonable for all concerned parties to want the most accurate, truthful, and correct information free of self-interested interpretations. Energy users, providers, and policy makers should all have access to the same information, and if we were all concerned with the right answer, there should never be two diametrically opposed answers. I will leave it to someone else to beat the dead horse lurking around the corner.

That’s the wishful thinking, and here is my personal disclaimer: I support climate change mitigation strategies which are known to reduce carbon emissions at the risk of reasonable cost. We must avoid hypothetical or failed strategies (cellulosic biofuels) and avoid those that are likely to bankrupt people.

So, is RGGI’s implementation of cap-and-trade known to reduce carbon emissions? If yes, is it at reasonable cost? These would be easier to answer if we could have a clear-eyed view.

Effectiveness:

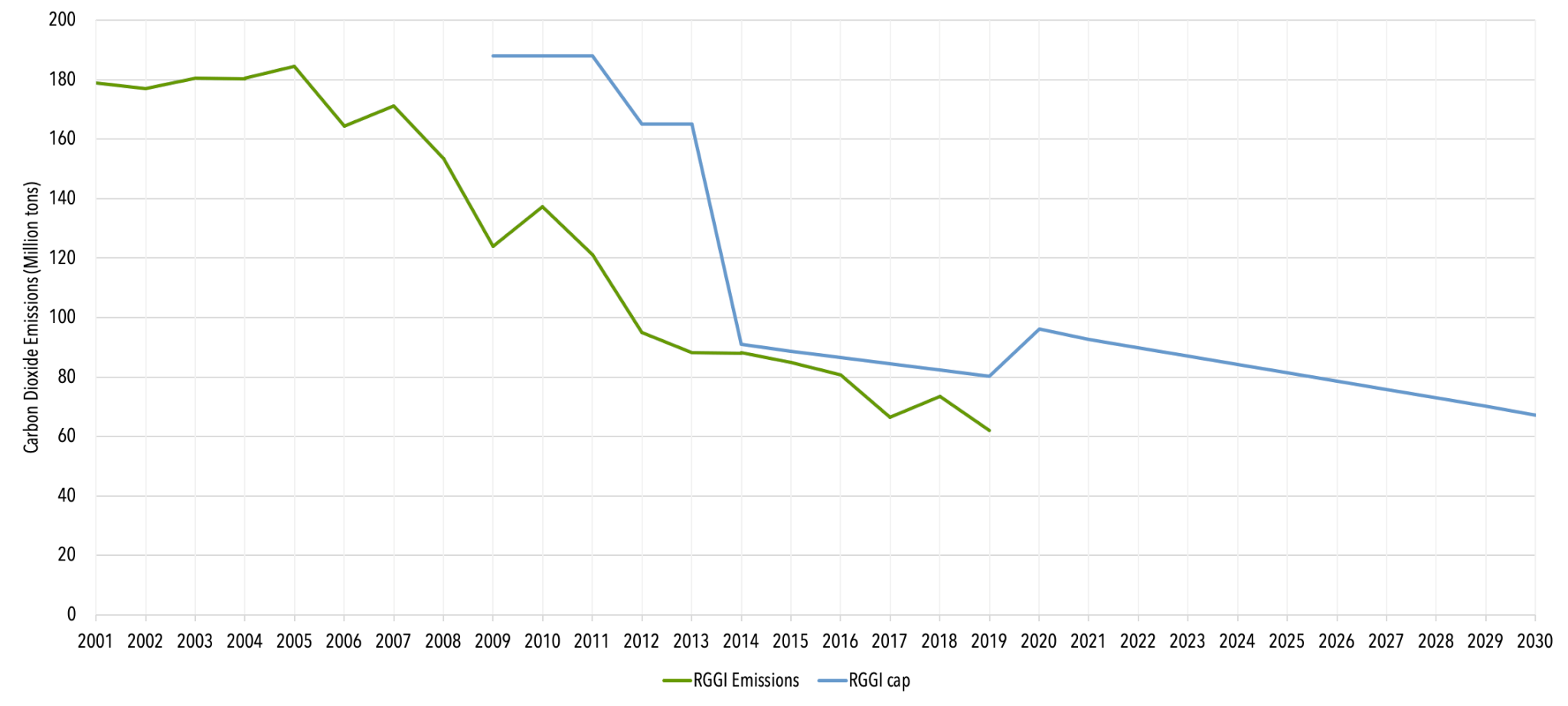

The RGGI Project Series says on their website “While electricity production accounted for over 30% of economy-wide carbon emissions across the RGGI states… electricity sector now accounts for about 20%” (RGGI Project, Performance). To me, that seems clear implication that RGGI states, as a group, reduced electrical sector emissions by 10%, which is not an insignificant value. Additionally, the RGGI Project Series states that annual carbon emissions in RGGI participating states dropped over 50% since 2009 “due in part to RGGI and other factors” (RGGI Project, Performance). This is a less clear statistic, which could hint at states valuing carbon reduction plans, as signified by being in RGGI, are likely to further reduce emissions through other-than-RGGI strategies. Interestingly, RGGI’s published fact sheet echoes the 50% reduction, but does not specify in what sectors emissions were reduced (RGGI, 2021). From the few reports I’ve seen, RGGI focuses on the volume and cost of carbon allowances and less on the percent reduction or tons less emitted. Of the positive reviews, the most informative comes from the Center For Climate and Energy Solutions (C2ES). The below graph is from their website and shows the changes in emissions since RGGI implementation. C2ES provides a relatively information-dense summary of RGGI, offering a good summary of the program’s purpose, history, and performance.

Following program reviews, the RGGI allowance cap was adjusted in 2014 and in 2020. The allowance cap increased in 2020 due to New Jersey rejoining RGGI and increased again in 2021 due to Virginia joining. RGGI states have set a cap to reduce power sector carbon dioxide emissions 30 percent below 2020 levels by 2030.) Graph, graph title, and notes sourced from C2ES.org (C2ES)

In contrast, an article from the Institute for Energy Research (IER) states, “While the RGGI program has done little to impact the amount of carbon emitted by its participating states, it has succeeded in imposing additional costs on energy transactions.” (Lambermont, 2022). That’s it. There is no citation or numerical value applied, just the statement that RGGI is ineffective. A statement coming from a group such as the IER carries some weight of authority. However, any claim about any change in a measurable variable must include a value of that change – a number, a rate, some data point. A clause that it is ineffective presumes the bias of its readers and is lazy at its least complicit. Now, an article by the Allegheny Institute for Public Policy digs into the heart of the carbon emissions claimed by RGGI and is quite effective at its intended purpose: turning the reader off of RGGI. It provides a strong challenge to RGGI to ensure that they provide definitive, unarguable data proving the program’s ability to reduce carbon emissions outside of any other external economic and global influences. Ultimately, the high-level data indicates that carbon emissions have lowered in RGGI states while the cap-and-trade program was in effect. However, it seems fidelity is required to demonstrate what factors contributed to those reductions and by how much.

Sounds like a tall task.

Cost:

What about cost, which was the Governor’s main concern? This becomes murkier, and the best I intend to do is provide the values that I’ve found from the resources I’ve already cited and let those speak for themselves. Here’s a list of numbers supporting and accosting RGGI’s economic impacts traceable to sources already mentioned:

- Raised $4 billion to invest in local communities since inception (RGGI, 2021).

- Virginia received $227.6 million in allowance actions in its first year, applying 50% to energy efficiency programs, 45% to flood prevention and coastal resilience programs, and 3% to state climate planning efforts per the Clean Energy and Community Flood Preparedness Act (Steger, 2022).

- From 2015-2017, RGGI states gained an accumulated $1.4 billion in net economic value, reduced state payments to fossil fuel suppliers outside of the RGGI group by $1 billion, while RGGI state electricity consumers saved a net $99 million, and natural gas/heating oil consumers saved $121 million (Analysis Group, 2018).

- RGGI would cost ratepayers between $1 and $1.2 billion over the course of four years (Lambermont, 2022).

- The $4 billion in net benefits constitutes only 0.12% of the combined RGGI states’ GDP of $3.25 trillion during the same reporting period (Allegheny, 2019).

Clear as mud.

Here’s my takeaway and attempt to summarize: RGGI auctions have raised money for their respective states. This is not argued. The magnitude of that money as a fraction of state GDP may be very low (i.e. 0.12%) and still be a very large sum of money. It is up to the state to disburse those proceeds as implemented by that state’s own laws. Energy companies, like Dominion, must negotiate with regulators to set rates that are fair. This does not always occur fairly (Vogelsong, 2021). It is unknown based on the information I’ve provided how the $1 to 1.2 billion increase over four years translates to $/kWh (or $/Therms) to meaningfully explain the impact to monthly energy bills.

This goes back to the problem with information: decisions affecting each ratepaying Virginian are being made using the same high-level data but with different biases and levels of specificity. With resignation, I trust decisions to be made not with the right answer in mind, not with the correct analysis, but to be made based on the interests of those parties to which the decision makers belong. I would trust any Joe Republican to pull out of RGGI if allowed to, any Jim Democrat to put Virginia back in, and both to play to their tropes without deviation. The individual is inconsequential. And in no waking day would I ever trust to a major energy company to place environmental concerns over profitability and expansion. They are not paid to do that. In fact, some companies run into problems complying with environmental regulations, with or without using regulations as a scapegoat for overcharging customers (Dominion v. EPA, 2013, Vogelsong, 2021, Environmental Defense vs Duke Energy, 2006, Bowman, 2022), etc.).

I want to highlight a key point made by the Analysis Group which needs to be repeated here (emphasis mine): “RGGI is not and never was meant to be an economic development program. RGGI’s purpose is to reduce CO2 emissions from power generation in order to help mitigate the economic, social, and environmental risks of climate change” (Analysis Group, 2018, pg. 10). It’s easy for the argument to get so focused on economic impacts that we forget that programs like RGGI are a tool for a purpose: to lessen the impacts of climate change.

One last item, because I don’t want to let it go. Virginia is not a lead exporter of people to other states, contrary to the Governor’s hyperbolic claims. In climate change and energy policy, it is money that stakeholders care about, not individuals, not your environment, not your kids’ climate. You just need to know who you’re talking to.

Back in Action, or a Reprieve to the Nothing?

An Article for Your Review

Flagship UN study shows accelerating climate change on land, sea and in the atmosphere

The funny thing about working on a graduate degree is that it does wind up taking a lot of your free time, and some of the great ideas you had about writing go out the window while your occupied with other things dictated by the weekly schedule. So that is my preface to the fact I have spent years away from this website. However, small 10 to 15 minutes attempts to stay current are not going to kill me, though they may lack the same rigor I’d prefer.

To get back into it, rather than introduce an analysis into any particular policy or article, I’ve provided this as a climate change status report. Why this one? Because I think the World Meteorological Organization should have access to adequate data and because I think this is a kind of information that is under-represented in the news. This article provides the snapshot of where we are, where we’re going, and what we used to look like regarding the basic climate change parameters.

What I want you to do, before reading the actual article, is to look at the graphs provided at the bottom of the webpage. Once you’ve reviewed them, you should be able to see the trends in order to get the big picture.

My key takeaways are, shock and surprise, we are not doing what we need to in order to avert the worst scenarios of climate change. Understanding both the presence of multiple projections of the final ballpark temperatures by century’s end and the uncertainty in assigning a direct weight-of-greenhouse gas to change in temperature, the fact is that the measured trajectories and trends are not disputed. Temperatures are rising, sea ice is melting, biodiversity is lowering. Although economies continue to grow, we should invest as much, if not more, uncertainty-based skepticism regarding the rate of economic growth and stability relative to the surrounding environmental changes. Frankly, I find this to be a depressing article, but I suppose most articles on this subject tend to be.

Capacity Factors, a Quick Comparison

For those who care about energy, you’re probably well aware of the Energy Information Association.

Something that I wanted to share came up during a discussion about wind versus nuclear energy. I think my general opinion on the current state of nuclear energy is below. If I were wishfully thinking, Small Modular Reactors (SMR) will prove to be reliably easy to install, cheap, and be able to turn public confidence in nuclear.

Wind, on the other hand, ignoring all the political spectrum jabs, has grown rapidly, dropped in its LCOE, and supported roughly 100,000 jobs according to the EIA’s 2017 Energy and Jobs Report. That’s a good thing. But I wanted to share this from the EIA’s Electric Power Monthly December data (https://www.eia.gov/electricity/monthly/epm_table_grapher.php?t=epmt_6_07_b)

Capacity factors: 2018 listed, plust trends from 2013 to 2018:

Nuclear: 92.6%, upward trend

Conventional Hydropower: 42.8%, net upward trend

Wind: 37.4% upward trend

Solar PV: 26.1%, upward trend

Solar Thermal: 23.6%, upward trend

Landfill/Municipal Solid Waste: 73.3%, net upward trend

Biomass: 49.3%, net downward trend

Geothermal: 77.3%, upward trend

My point? Nuclear power delivers when you give it the chance. You pay for that reliability, you pay for a 2000MW facility that delivers nearly all of that. Coal replaced traditional biomass, petroleum replaced coal in transportation, and natural gas is quickly displacing coal. I’m not going to demonize the energy source that propelled the industrial age and helped power civilization through its development in the last rough one-hundred fifty years. However, the Age of Coal, like many Ages before it, is ready to fade and gracefully allow better, cleaner, fuel sources continue to power humanity’s advancement. Nuclear can not be discounted as part of that future. Wind and solar are gaining ground, but a net reduction in carbon emissions won’t be met without nuclear as well. It is proven, it is available, it just needs to get its act together!

1/6/19: Dominion dominates SCANA but ratepayers continue to pay

https://www.apnews.com/ac733903c39f4eaa89fda67cd73731e4

As reported by the Associated Press , Dominion Energy has purchased SCANA, making the very large energy provider even larger. If you don’t know the history of SCANA’s involvement with the failed V.C. Summer unit 2 and 3 fiasco, then there is some reading you should do. The following link provides a good, bullet-by-date timeline of the history of the multi-billion dollar sinkhole: Dominion Energy completes buyout of South Carolina utility

The gist of it is this: the state of South Carolina passed a law, the Base Load Review Act, which allowed utilities to raise the rates on their customers in order to provide immediate and assured funding for construction and be able to revise rates throughout the construction period if necessary – in other words, customers pay for the generator years before it starts generating. The passage from the Base Load Review Act that I’m referring to is this (underlining is mine):

“SECTION 58-33-275. Base load review orders; parameters; challenges; recovery of capital costs.

(A) A base load review order shall constitute a final and binding determination that a plant is used and useful for utility purposes, and that its capital costs are prudent utility costs and expenses and are properly included in rates so long as the plant is constructed or is being constructed within the parameters of:

(1) the approved construction schedule including contingencies; and

(2) the approved capital costs estimates including specified contingencies.

(B) Determinations under Section 58-33-275(A) may not be challenged or reopened in any subsequent proceeding, including proceedings under Section 58-27-810 and other applicable provisions and Section 58-33-280 and other applicable provisions of this article.

(C) So long as the plant is constructed or being constructed in accordance with the approved schedules, estimates, and projections set forth in Section 58-33-270(B) (1) and 58-33-270(B)(2), as adjusted by the inflation indices set forth in Section 58-33-270(B)(5), the utility must be allowed to recover its capital costs related to the plant through revised rate filings or general rate proceedings”

Without going into details (there are many), the failure summary includes the same issues plaguing other new nuclear energy facilities: cost overruns and schedule overruns. After successfully having a couple rate increases approved by the state, and after relations between SCANA/Santee Cooper and Westinghouse devolved, eventually the utilities pushed the state to the point of refusal, causing these utilities to draw a financial line in the sand – any more unseen cost overruns will be the responsibility of the contractor, Westinghouse (see Post and Courier). Westinghouse shortly thereafter declared bankruptcy. SCANA/Santee Cooper realized they couldn’t keep the project going, pulled the plug, and the people of South Carolina were left with billions of dollars of debt to redeem.

Thus Dominion Energy came to save the day and own another part of the U.S. energy infrastructure.

My thoughts on the general outcome of all this:

1) The nuclear energy industry has been stagnant for decades. This, and a project in Georgia, were the final survivors of over 100 potential licensees in recent years, hoped to bring about a “nuclear renaissance”. The phenomenal way V.C. Summer imploded serves nuclear energy’s critics as a bright and shiny example of why any other primary energy source is cheaper and more readily available to customers.

2) South Carolina, which has been served by nuclear power plants for years, will likely never again be so welcoming to nuclear energy again. This is significant when you consider that V.C. Summer unit 1 has been safely operating since 1984 to provide electricity to South Carolinians. After this mess, I doubt the state will welcome any new additions.

3) These units were approved at a time when projected growth showed that SCE&G (which SCANA owned) would not have the capacity to serve the anticipated population growth. Now that billions were wasted, there’s no new generation and more money will need to be invested for more capacity still.

4) The Base Load Review Act will serve as a prime example of what not to do when attempting to reform the way utilities have expansions approved. While the premise of front-loading capital costs during construction as opposed to afterwards was thought to save money, it didn’t. Theory is great until practice.

Generation Three nuclear power plants were supposed to herald in a resurgence of nuclear energy, boosted by a growing demand for energy sources that limited carbon emissions. No energy source is perfect. Every single one of them has its pros and cons, and if anyone ever tries to convince you otherwise, they’re either lying or a zealot. Sometimes you have to weigh those pros and cons against the end results you’re trying to achieve, and nuclear is one that immensely better than coal when it comes to air pollution. But not cost. If nuclear intends to survive, the only way it can is by convincing ratepayers, regulators, and politicians that it cost-competitive and can be delivered on time. Because that’s the bottom line.

First Note 12/25/18

For the sake of putting down a time stamp, this is the first entry for this blog. Trying to piece this website together to something coherent. Any entries of any particular worth to be made later.